Recently, I participated in an email discussion about the operation of some fiscal sponsors under a Section 501(c)(4) tax exemption, rather than a 501(c)(3) charitable exempt status. The discussion was kicked off by Geoff Link, Study Center executive director and head of Study Center Press, our publisher, and I then asked my former law partners from Adler & Colvin, Stephanie Petit and Rosemary Fei, to weigh in on the topic. We thought you might be interested.

Geoff: I find it troubling that some 501(c)(4)s claim to be engaging in fiscal sponsorship. If they’re not qualified under section 501(c)(3) of the Internal Revenue Code, they can’t provide tax deductibility to projects. If there’s no tax benefit to grantors and donors, do you think they can play a valuable role as fiscal sponsors?

Greg: I can see both sides of this question, Geoff. You’re right, the vast majority of those seeking and offering fiscal sponsorship will want the benefit of the tax-deductible donations and grants provided by a C3. But I know there’s a growing parallel phenomenon of social welfare C4s taking in projects to function under a nonprofit umbrella without the hassle of forming and operating their own corporations. The field of C4s is especially growing among politically active groups that want to do more lobbying and even electioneering — which they can, up to 49% without disclosing donors — at a level not permitted under C3 status.

And I think the same range of models would be available to them — A, B, C, D, L and F. Remember, C4s are “tax-exempt” in that they don’t have to pay income tax on their year-to-year excess of revenues over expenses as a for-profit business would, so they can accumulate assets tax-free. Also, many donors who are passionate about causes to “change the world” don’t care about the charitable deduction, especially those who make small donations online.

So, as we comprehend the whole realm of fiscal sponsorship, I think C4s should be placed in a separate category that has more freedom to act upon legislative and electoral controversies, but without tax-deductible funding. Stephanie and Rosemary, do you agree?

Stephanie: I agree. We’re seeing a lot of interest in 501(c)(4)s among clients generally, and even more since the Chouinard/Patagonia announcement. While C4s don’t offer their donors charitable deductions, donors can give appreciated assets without paying capital gains tax, they don’t owe gift tax on the gift, the C4 is generally exempt from income tax, as you said, and the money can be used for broader purposes, including lots of lobbying and some electioneering, as you also mentioned.

A downside of the C4 that I’m aware of is that if the donor gives during life and retains some control over the C4, at death the gift is pulled back into the donor’s estate for estate tax purposes with no corresponding deduction because it is not a C3 — but I wonder if that can be avoided if the donor has merely an “advisor” relationship to a fiscal sponsor, as opposed to sitting on the board, for example.

So I think there may be a lot of potential for growth in C4 fiscal sponsors, which obviously offer different benefits than a C3 fiscal sponsor.

Rosemary: In addition to agreeing with everything Stephanie said, I know of at least four active C4 fiscal sponsors, so it’s happening already. We don’t know if that’s exceptional, or just the tip of the iceberg.

Geoff: Thank you, Rosemary, Stephanie and Greg for responding so knowledgably and thoughtfully about this issue. You’ve broadened my understanding of C4s’ role in fiscal sponsorship, though their use might sometimes be motivated more by the donor’s desire to advocate for governmental change than to nurture projects that provide ongoing services to the community. I agree that lobbying can be an immense service to the community, but it’s not at all like opening a homeless shelter or serving meals to the elderly.

A C3 fiscal sponsor that chooses to count its lobbying under Section 501(h) [up to 20% of expenditures] would seem a useful option when community service is the primary goal.

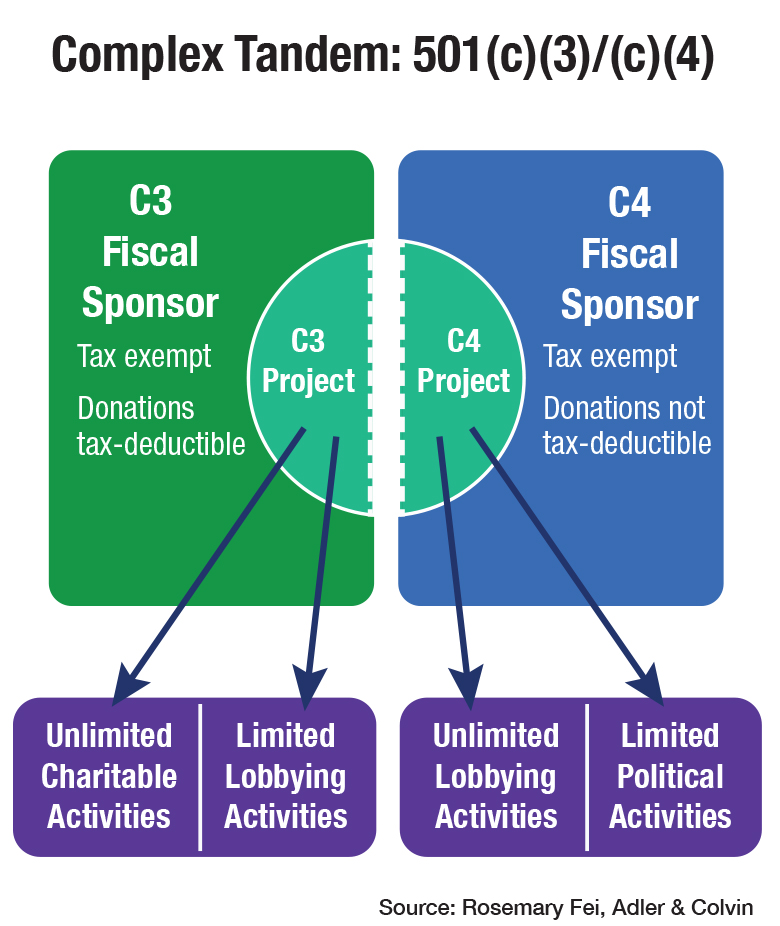

Rosemary: Geoff, one thing we’re seeing is that a C3 sponsor will have a C4 sponsor affiliate, and there will be a C3 project sponsored by one, with a lobbying affiliate sponsored by the other, allowing much smaller, newer charities to get used to tandem structures before they even spin out as independent entities. There are some C4-only sponsored projects, but the vast majority I’ve seen are C3-C4 tandems, both sponsored by affiliated sponsors. When we talk about C3-C4 tandems, we always hear from clients that they want the two entities to be “seamless,” and we respond that, no, the seams need to show. [See diagram above.]

Greg: Throughout our development of the fiscal sponsorship concept, we’ve had a place where we discuss C3-C4 tandems. In the 3rd edition of Fiscal Sponsorship: 6 Ways To Do It Right, page 55, we describe how a C3 can receive charitable donations and grants, then regrant them to its C4 affiliate with discretion and control under Model C, restricting use of the funds to C3 purposes. The Sierra Club Foundation and the Sierra Club have such a tandem arrangement.

Sometimes the C4 controls the C3, and sometimes the reverse, or the two are legally independent but share their brand in their legal names. Either way, the C4 is really a project or a collection of projects, and the C3 is the sponsor under Model C.

Hey, everyone, thanks for participating in this dialogue. Hopefully this will both clear up a bit of confusion and illustrate how fiscal sponsorship structures can be a powerful tool to pursue social change involving governmental policy decisions.

Stephanie Petit, Greg Colvin’s co-author of Fiscal Sponsorship: 6 Ways To Do It Right, and Rosemary Fei are Principals at Adler & Colvin.